The regulation virtual asset market in South Korea

The first virtual asset business in South Korea began in 2013. Since then, the virtual asset industry has naturally become part of the regulated sector. A regulated industry is one that is subject to strong oversight by government or supervisory authorities, usually due to its significant social impact. Let’s take a closer look at the regulation of the virtual asset market in Korea.

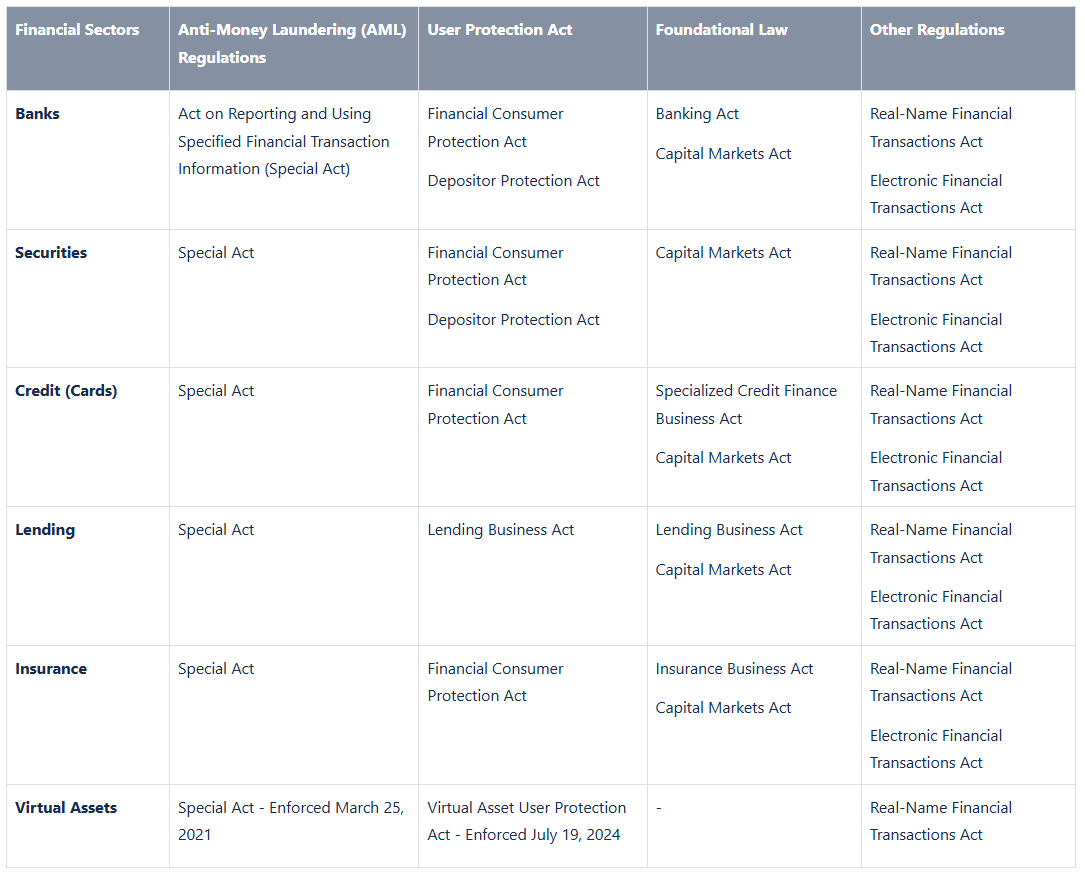

The status of Virtual Asset Service Providers (VASP) was established with the enforcement of the revised Special Financial Information Act (Special Act) on March 5, 2021. Recognizing that financial services could facilitate the circulation of funds linked to terrorism or other illegal activities, the initial regulatory focus was on preventing money laundering risks.

On July 19, 2024, the Virtual Asset User Protection Act was enacted. Since 2021, there have been instances of illegal operations causing harm to users, and to prevent such issues, more detailed laws were defined to ensure protection for virtual asset users. This law mandates requirements that virtual asset service providers must adhere to for user protection.

Next, as in other industries, a foundational law for the virtual asset sector is expected to be established and enforced. From a regulatory perspective, virtual assets are gradually being integrated into the financial sector, signaling a progressive recognition of virtual assets as part of finance in society.

Wavebridge is also committed to being a trustworthy virtual asset service provider by faithfully implementing regulations to offer a stable and reliable service for users.